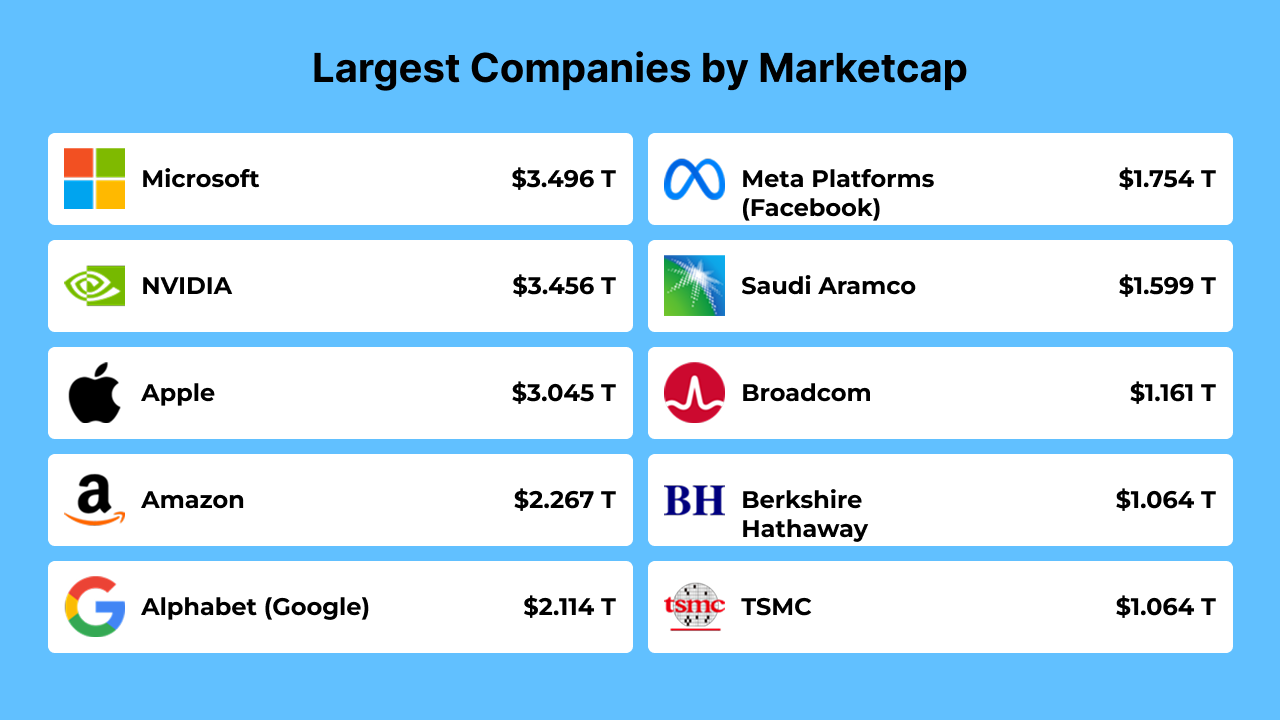

As of June 2025, the global financial landscape continues to be dominated by a handful of powerful technology giants, with market capitalizations measured in the trillions. The title of the world’s most valuable company currently belongs to Microsoft, with a staggering market capitalization of $3.496 trillion. Microsoft’s dominance is anchored by its strong performance across cloud services, enterprise software, and its rapidly expanding AI and cybersecurity offerings.

In a very close second place is NVIDIA, now worth $3.456 trillion. The company has seen explosive growth fueled by global demand for AI chips and data center GPUs, making it one of the most significant forces behind the AI revolution. NVIDIA’s rise to near the top of the corporate hierarchy marks a historic moment for a company originally focused on gaming graphics.

Apple, long a mainstay of corporate leadership, holds the third position with a market cap of $3.045 trillion. While the company remains a leader in consumer electronics and services, its recent market performance suggests it is feeling pressure from competitors in AI and hardware innovation. Nonetheless, Apple continues to be a key player with a loyal customer base and a strong product ecosystem.

Amazon ranks fourth with a market cap of $2.267 trillion. Its continued strength in e-commerce is complemented by the sustained success of Amazon Web Services (AWS), which remains one of the largest and most profitable cloud computing platforms in the world. Amazon’s logistics network and investment in AI-driven retail services also contribute to its valuation.

Alphabet, the parent company of Google, comes in fifth with a market capitalization of $2.114 trillion. Alphabet’s massive influence in search, advertising, cloud infrastructure, and AI research solidifies its standing among the top technology conglomerates globally. Innovations in generative AI and dominance in digital ad revenues keep it at the forefront of the tech sector.

Meta Platforms, formerly known as Facebook, occupies the sixth position with a value of $1.754 trillion. Meta’s strategic investments in virtual and augmented reality, alongside the continued growth of its social media platforms and advertising business, have paid off. Its transition toward a metaverse-focused company has been gradual but financially rewarding.

The seventh spot is held by Saudi Aramco, the largest non-U.S. company on the list, with a market capitalization of $1.599 trillion. As the world’s most valuable oil company, Aramco’s valuation reflects sustained global energy demand and high oil prices, despite the shift toward renewables and green energy.

Broadcom, a major player in semiconductors and infrastructure software, ranks eighth with a market cap of $1.161 trillion. The company has seen strong investor confidence due to its strategic acquisitions and deep integration into enterprise and telecom hardware solutions. Its growth is further supported by AI and 5G infrastructure demand.

Berkshire Hathaway, the massive conglomerate led by Warren Buffett, holds the ninth position with a market valuation of $1.064 trillion. Known for its diversified portfolio that includes insurance, utilities, railroads, and consumer goods, Berkshire remains a pillar of traditional American capitalism.

Tied with Berkshire Hathaway in market value is Taiwan Semiconductor Manufacturing Company (TSMC), also at $1.064 trillion. TSMC plays a foundational role in the global tech ecosystem as the leading contract chip manufacturer for companies like Apple, NVIDIA, and AMD. Its advanced process nodes and capacity leadership in semiconductor fabrication make it a strategic asset not only for Taiwan, but for the entire global economy.

Together, these companies illustrate the immense concentration of value in the tech and energy sectors, with U.S. firms continuing to dominate the top of the leaderboard. From AI and cloud computing to semiconductors and digital platforms, the firms that are shaping the future of the global economy are now worth more than ever.